Economics

When Greg Klump talks, large swaths of Canada's financial and policy-making sectors pay close attention.

Greg is CREA's chief economist, and it's his job to analyze and forecast resale housing activity and prices at the provincial and national levels, information that is heavily relied upon by all the banks, by government departments and agencies like Finance Canada and the Bank of Canada, by the news media that report on the housing sector, and by related trade associations.

His numbers are also critical for buyers and sellers of real estate and for the REALTORS® who work with them, making economic analysis and reporting one of the most essential services CREA delivers to its members and to the broader Canadian public.

Housing is a unique sector of the economy. Buying a house is a huge and deeply personal decision for most people and that can inject more emotion into the process than is the case with manufacturing, for example. At the same time, the housing construction and resale market accounts for about $23 billion in economic activity every year, and the state of the sector is seen as a critical economic indicator because of its influence on job creation and consumer spending. As a result, there can be a great deal of uncertainty – and no small amount of myth-making and misunderstanding – about the housing sector in Canada, Greg said, "What we do here at CREA is provide a dispassionate, logical and truthful analysis of what's going in Canada's housing market."

Noting that CREA was established in the first instance to lobby on behalf of REALTORS® at the federal level, Greg added "the housing market information we bring to the table in our dialogue with the government is highly valued. Policymakers need to know the impact of various measures on the housing market. And they look to CREA for expert information on that."

For example, Greg said, there has been a lot of concern in some quarters that the most recent government changes to mortgage regulations would initiate "a downward spiral for the Canadian housing market. In fact, our analysis shows that the changes the government has made to mortgage regulations over the past five years have achieved the soft landing that they were engineered to bring about." The flipside of that coin is that CREA's analysis has also shown that taking some even more severe measures, such as increasing the size of a minimum down payment, would be a step too far.

CREA's lobbying efforts were key to the introduction several years ago of the Home Buyer's Plan that allows first-time home buyers to withdraw funds from their Registered Retirement Savings Plans to cover some or all of their down payment. Today, the economic analysis that Greg and his colleagues produce underpins the Association's efforts to index the program and to expand the range of circumstances under which home buyers can use it. "Giving the government our numbers on what the HBP means for job creation and for spin-off spending in the economy is aimed at encouraging the government to index the plan in increments."

When any economic activity has as big an impact on both public policy and private wellbeing as the buying and selling of houses, it's critical that everyone have a clear picture of what's going on. "We provide a reasonable interpretation of what's going on in housing markets. And everyone else relies on that because it is reasonable."

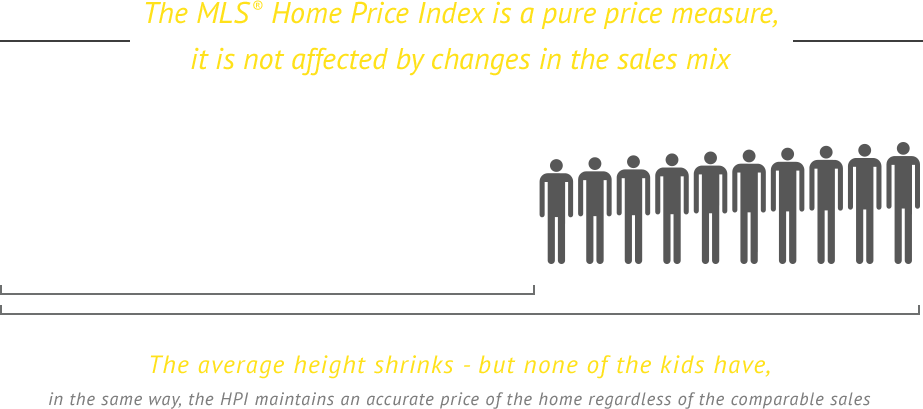

MLS® Home Price Index

"Imagine you lined up all the kids in a class organized from shortest to tallest and calculated their average height," said CREA Chief Economist Greg Klump. "Now take away the 10 tallest kids and calculate the average height again. All the kids left behind are still the same height, but the average will have shrunk." That's the analogy Greg uses to explain the advantage of the MLS® Home Price Index, now being used in Canada's five largest real estate markets and soon to be rolled out elsewhere. Unlike average selling prices that can be distorted by a burst of high-end or low-end sales, the MLS® HPI is a neighbourhood-by-neighbourhood approach based on the value home buyers assign to various housing attributes, which tend to evolve gradually over time

The MLS® HPI tells buyers where prices are going for the neighbourhood and type of house they're interested in. This helps them make better decisions when it comes to arranging their financing. For sellers, the MLS® HPI helps them get the best price for their house while still being competitive in prevailing market conditions.

For REALTORS®, the MLS® HPI is a potent tool in pricing a listing because it gives them detailed information on trends at the neighbourhood level and for various types of housing and features, letting them demonstrate they are experts in their markets.

"Imagine you lined up all the kids in a class organized from shortest to tallest and calculated their average height," said CREA Chief Economist Greg Klump. "Now take away the 10 tallest kids and calculate the average height again. All the kids left behind are still the same height, but the average will have shrunk."